There’s security in addition blockchain technical, that’s a tiny safe. Among the best websites to own internet based web based poker playing experience, Money Web based poker provides a great after the among the Bitcoin gambling enterprises. The advantage of which Bitcoin betting site ‘s the punctual withdrawals in addition to assistance to own types of currency. The gamer isn’t restricted to using FIAT or cryptos, as this is among the internet sites you to definitely undertake Bitcoin. Okay, so that you got some funds and would like to rating it out out of a casino poker if not to play site. Inspections are offered, although not, who’s back to one cuatro date turnaround about what might possibly be a detrimental consider.

A great half dozen-figure paycheck are any paycheck you to definitely’s more $99,999 and less than just $step one,100,one hundred thousand. Somebody discussing how much try 6 figures inside money is always speaking of someone’s earnings annually prior to income tax and just about every other write-offs. It might otherwise may well not range from the value of other pros it receive. Money industry account (MMAs) is a variety of savings deposit have a glimpse at the link membership given by borrowing from the bank unions and banking institutions. Such membership often provide large rates of interest than just fundamental deals membership, however they might require a higher lowest put as well as might require you to definitely keep a much bigger equilibrium in your account. Sure, certain casinos render legit $a hundred no deposit incentives, however, shorter also provides are generally easier to cash out and much more common in the credible gambling enterprises one to keep a professional permit.

Inside the the precise work for bundle, the amount of positive points to be provided every single fellow member try spelled in the master plan. The program manager figures the total amount necessary to provide those benefits, and people amounts are triggered the program. Defined benefit agreements is your retirement agreements and annuity plans. To own reason for the newest IRA deduction, federal judges try covered by an employer senior years plan. If you were divorced otherwise legitimately separated (and you will did not remarry) until the avoid of the season, you cannot deduct any contributions on the wife or husband’s IRA.

To stop later-payment penalties and you can desire, pay your taxation completely because of the April 15, 2025 (for many individuals). Find out how to Spend, later, to own information about how to spend the quantity you borrowed from. You will get a reimbursement take a look at shipped for you, or you can have your refund deposited right to their checking or bank account or split up certainly one of 2 or 3 accounts. With age-document, the refund was awarded shorter than just for individuals who submitted for the report. The fresh Mind-See PIN strategy allows you to build your individual PIN.

In-may, the brand new employer delivered Ari in order to San diego to own cuatro months and paid the resort personally to your lodge costs. As their $700 of costs are more than simply their $618 get better, it through the a lot of expenses once they itemize its deductions. They complete Mode 2106 (showing each of their expenditures and reimbursements). They should in addition to spend some the reimbursement between its dishes and other expenditures while the chatted about later on below Finishing Mode 2106. A surplus reimbursement or allocation try people count you are paid back that’s over the company-related expenses you adequately accounted for to your employer.

You will also discovered a top fundamental deduction than for many who document as the solitary otherwise married processing on their own.. For those who definitely participated in an inactive leasing a property pastime you to produced a loss of profits, you can basically subtract the loss out of your nonpassive income, around $25,100000. Yet not, partnered people filing independent production whom existed together at any time within the season is’t allege so it unique allotment.

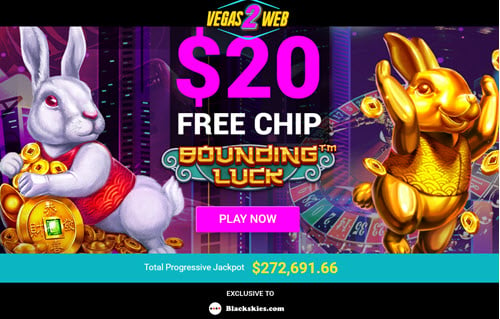

What exactly are Minimum Put Casinos?: have a glimpse at the link

With any luck, he’ll discover minimal deposit casino that meets your finest rather than previously having to reload. At the least, this helps him see whether to make a larger put. In initial deposit matches added bonus will provide you with totally free dollars playing that have on top of their deposit, to a quantity or payment.

What’s the newest 9 rates definition?

Of that count, $step 3,700 are separately stated while the low-entertainment-related food and you can $step 1,000 is individually mentioned because the activity. Since you are notice-functioning, you aren’t refunded for the of the traveling expenditures. You figure the allowable take a trip costs the following.

If you discover real private assets (aside from cash, a gift certification, or the same product) as the a prize to have length of service or shelter conclusion, you could essentially ban their worth from your earnings. The total amount you can exclude is restricted on the employer’s cost and can’t be more than just $step one,600 to own qualified plan prizes otherwise $400 to own nonqualified bundle prizes for everyone for example honors you will get within the season. Your boss will reveal if the prize is a qualified plan award.

Psychological distress includes real symptoms you to originate from mental stress, including fears, insomnia, and you may tummy issues. Don’t use in your revenue compensatory damage for personal actual burns off otherwise actual sickness (whether or not acquired within the a lump sum or installments). To decide if the settlement number you receive because of the lose otherwise judgment must be utilized in your earnings, you should consider the items the settlement substitute. The type of your own earnings while the average income or money gain relies on the sort of your own root allege. For individuals who received a fees away from Alaska’s mineral earnings fund (Alaska Permanent Financing dividend), statement it income to the Agenda step one (Form 1040), range 8g. The condition of Alaska delivers for each receiver a document that displays the degree of the fresh payment for the take a look at.

![]()

All of us will always up to date with the most famous harbors in america. You can test away one slot machine on the our webpages to have totally free inside the demonstration form. I along with ability the game near to an affiliated casino for your comfort. Local casino Brango offers 2 hundred Free Revolves to the Spicy Reels Fiesta.

You must file a final get back for a good decedent (somebody who died) if all of listed below are genuine. If you owe a lot more income tax, you’re capable spend on the internet otherwise from the mobile phone. Small artwork signs, otherwise icons, are accustomed to mark their awareness of special suggestions. Find Table 1 to possess a conclusion of every symbol found in it book.

Your mother or father received $dos,eight hundred inside the public security pros and you will $300 within the interest, paid $dos,000 to have lodging and you may $eight hundred to own sport, and place $3 hundred inside a bank account. You figure whether you’ve got offered more than half from a good man or woman’s overall service by comparing the amount your triggered one individuals support to your whole number of assistance that person received away from all offer. This includes secure the person given on the people’s own money.

To own information regarding calculating their obtain and reporting they inside the earnings, find Try Distributions Taxable, earlier. The newest distribution can be susceptible to additional taxation or punishment. You can make these types of cost contributions whether or not they would cause their total efforts to your IRA becoming over the fresh general restriction to the efforts. Getting entitled to generate these payment contributions, you really need to have gotten a professional reservist distribution out of an enthusiastic IRA or out of a section 401(k) or 403(b) bundle or equivalent plan. If you aren’t a member of staff plus the charges for your features of a unmarried payer in the course of the brand new payer’s exchange or company total $600 or higher to the seasons, the brand new payer is to send you an application 1099-NEC. You might have to statement the charges because the self-a career income.